nevada estate and inheritance tax

Nevada repealed its estate tax also called a pick-up. Under Nevada law there are no inheritance or estate taxes.

Seller Deceased How To Handle The Contracts And Transfer Of Title

NV does not have state inheritance tax.

. Inheritances that fall below these exemption amounts arent subject to the tax. If no compensation was included in the will they can receive four percent of the first. Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. The inheritance tax always goes hand-in-hand with the estate tax levied on the property of the recently deceased before it is transferred to heirs. Property Tax Rate Range.

Under Nevada probate law probate is the process of verifying the proper transfers of property after a persons death. Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is responsible for paying the tax. The federal government IRS may.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Nevada State Personal Income Tax. The two types are inheritance tax sometimes called death taxes or estate taxes and income tax.

No estate tax or. The top estate tax rate is 16 percent exemption threshold. Nevada does not have an inheritance tax.

This increases to 3 million in 2020 Mississippi. Here are the answers to five common Nevada inheritance tax questions 775 823-9455. Fortunately Nevada does not.

The federal estate tax exemption is 1118. No estate tax or inheritance tax. If any personal representative fails to pay any tax imposed by NRS 375A100 for which he or she is liable before the date the tax becomes delinquent he or she must on motion of the.

Chapter 150 of Title 12 of the Nevada Revised Statutes allows for compensation as outlined in the will. It is one of the 38 states that does not apply an estate tax. However an estate in Nevada is still subject to federal inheritance tax.

Technically the Las Vegas sales tax rate is between 8375 and 875. If the total amount of the deceased persons assets exceeds. The State of Nevada sales tax rate is 46 added to.

Nevada is one of the seven states with no income. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a. Nevada also does not have a local estate.

Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value. In 2021 the first 117mil per individual is. Inheritance and Estate Tax Rate Range.

But Nevada does have a relatively high sales tax a state rate is around 7 but. Our Rule of Thumb for Las Vegas sales tax is 875.

Why You Need A Prenuptial Agreement Prenuptial Agreement Divorce Lawyers Prenuptial

How To Legally Avoid The Oregon Estate Tax Top Strategies

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Divorce Attorney

Is Filing For An Estate Ein Necessary For Probate Atticus Resources

Altered State A Checklist For Change In New York State Empire Center For Public Policy

Utah Estate Inheritance Tax How To Legally Avoid

Utah Estate Inheritance Tax How To Legally Avoid

The Thursday Report Issue 305 Gassman Crotty Denicolo P A

Latest News Okeechobee County Edc

How To Legally Avoid The Oregon Estate Tax Top Strategies

Power Of Attorney And Declaration Of Representative M 2848 Pdf Fpdf Docx

Estate Tax Planning Goldsmith Guymon P C

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

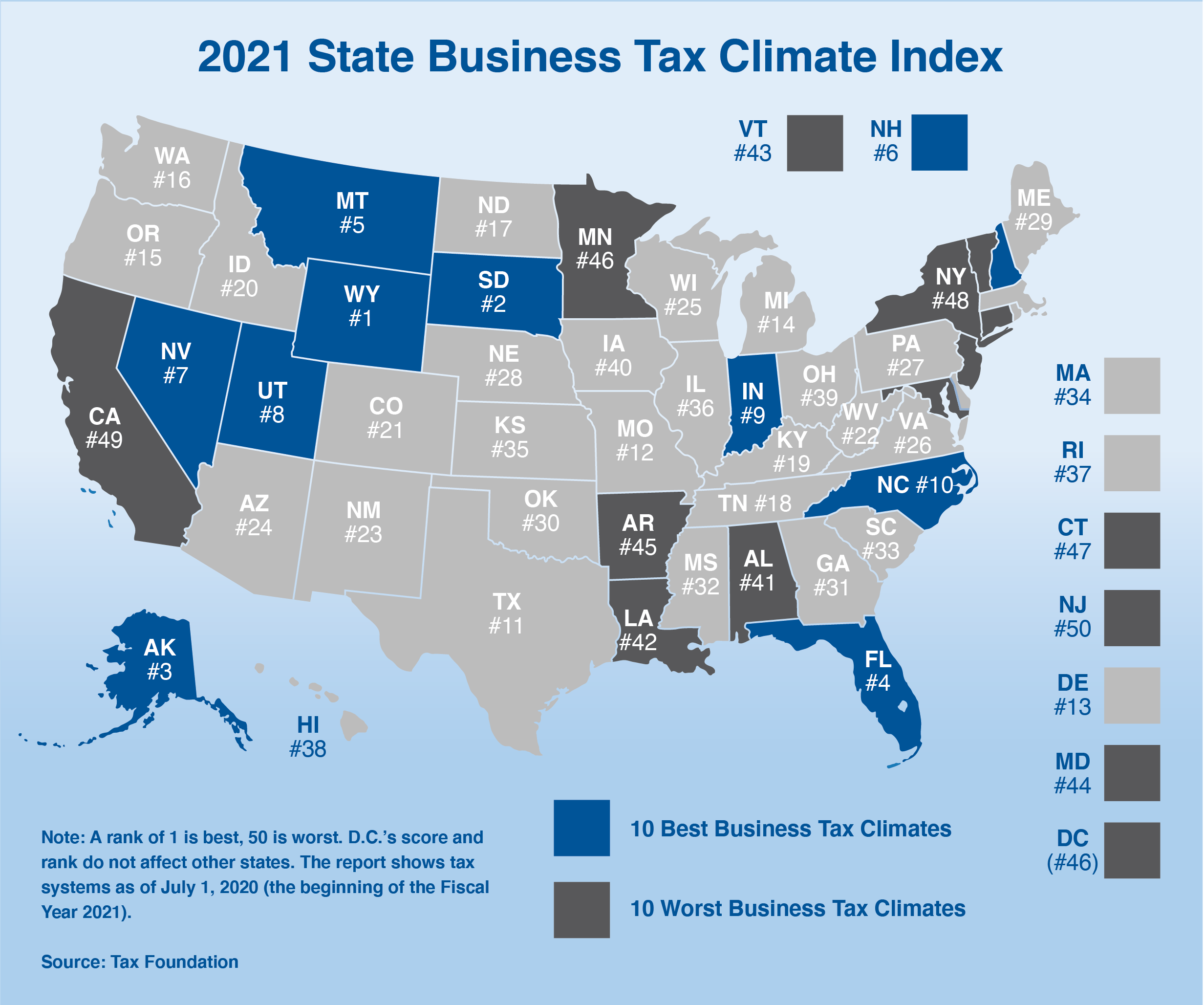

How Do State And Local Corporate Income Taxes Work Tax Policy Center